Investment advisers recommend clients hold a diversified portfolio consisting of a mixture of U.S. and international stocks and bonds as a way to spread out risk and benefit from areas that may be rising while others are declining. Diversification usually results in lower losses during down markets and smaller gains during rising markets, offering a smoother ride than investing entirely in the S&P 500 stock index ETF.

The problem with diversification is that it doesn’t always feel like the best strategy. During the current bull market, the S&P 500 has been one of the best performing asset classes in the world so it’s natural to wonder if diversification provides any benefits at all. Investing can be emotional and the steadier returns generated by diversification can feel disappointing. No one likes to lose money and few people are satisfied when not fully participating when markets take off.

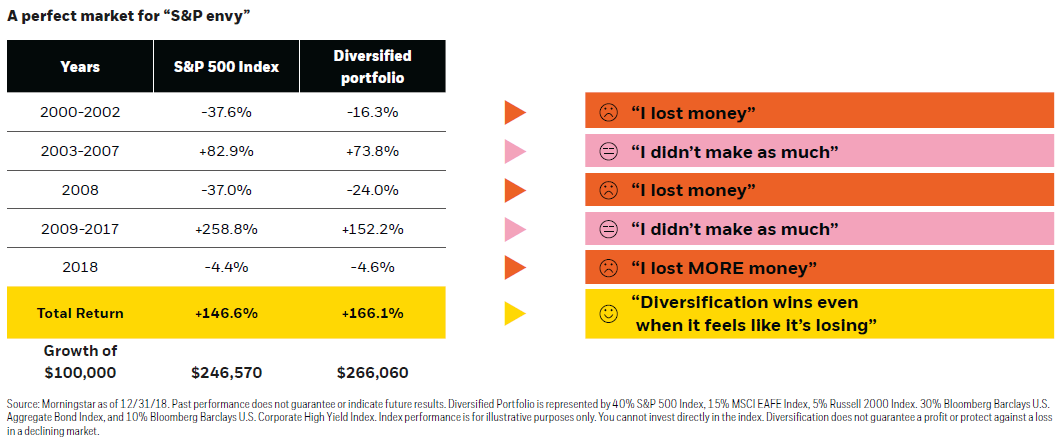

The chart below illustrates this dilemma by showing the actual market performance of the S&P 500 index versus a diversified portfolio during the period from 2000 through 2018. The diversified portfolio consists of 40% of the S&P 500, 15% of the international MSCI EAFE index, 5% of the Russell 2000 index of smaller U.S. companies, 30% of the Bloomberg Barclays U.S. Aggregate Bond index and 10% of the Bloomberg Barclays U.S. Corporate High Yield Bond index.

Investors are never happy when they lose money. Even though the diversified portfolio declined by less than the S&P 500 during the dot-com crash of 2000-2002 and the Great Recession in 2008, it still didn’t feel good for investors to suffer declines of 16% and 24%. When the S&P 500 gained ground in 2003-2007 and boomed from 2009-2017, diversified investors likely felt like they were missing out because they weren’t making as much as the soaring S&P 500. In 2018, it was the worst of both worlds for diversification because the S&P 500 declined 4.4% yet the diversified portfolio was down even more with a 4.6% loss.

The benefits of diversification are shown at the bottom of the chart. At the end of this long, seemingly frustrating period, the diversified portfolio gained 166.1%, actually beating the S&P 500’s 146.6% gain. Even though it may not have felt good during those two decades, diversification worked.

The key to this long-term outperformance was how the diversified portfolio performed during the market downturns. Diversification provides downside protection, which is a vital component of long-term returns. Investments that provide good downside protection don’t usually participate as well on the upside when markets are rising, but since they have lost less ground they can recover those losses more easily and don’t need to rise as much to provide benefits.

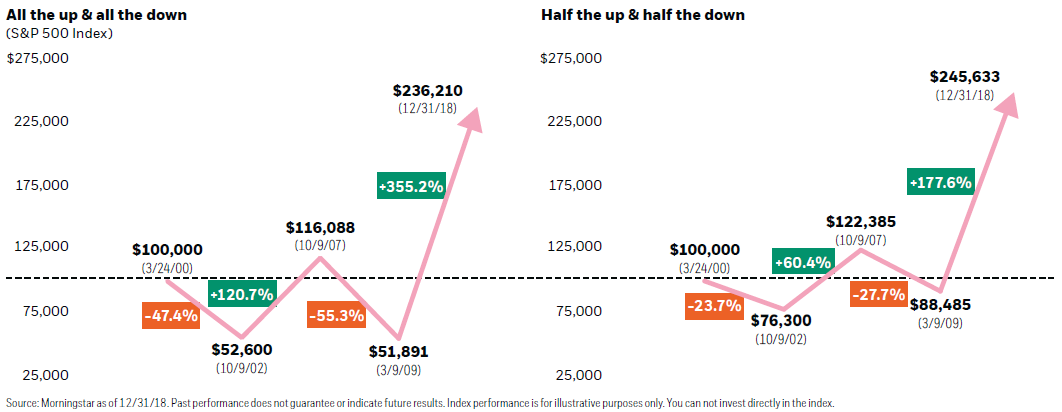

The concept is best shown graphically. The chart on the left shows the results of exposure to 100% of the upside and 100% of the downside of the stock market. You can see that $100,000 invested in the S&P 500 in 2000 would have been worth $236,210 by the end of 2018.

The chart on the right shows the results if you invested in a portfolio that had 50% of the downside and 50% of the upside of the stock market over the same period. This portfolio would have been worth $245,633, or slightly more than the all stock portfolio. In other words, having robust downside protection, even with conservative upside participation, resulted in slightly better returns with half the volatility of investing in the stock index.

I understand that we are not all robots and that investing is emotional. It is only natural to feel some concern as diversified portfolio returns lag when the market is hitting record highs. Emotional investing moves rarely pay off as markets can reverse themselves abruptly. Superior long-term performance is not about beating the market in any given year in a bull market. Controlling losses in down years is just as important, if not more so, to achieving long-term investment goals.

Social Media